Earlier this month, I hosted Valeo’s “Tipping the Scales” rate setting webinar where I shared a recap into Q1 2024 Partner and Associate hourly rates for the year. In addition to monitoring and analyzing the rates through the Valeo Attorney Hourly Rates Pricing Platform, I also shared trends and a look into the “why” the rates are performing they way they are and what we can expect for the remainder of the year. Take a read, and I’d love to hear from you if these numbers were on par with what you were tracking and anticipating for your year, as well.

Fast Facts from Q1 2024

Q1’s momentum was quite impressive after a strong year end. A summary of Q1 data is as follows:

- Hourly rates increased in Q1 2024 vs. 2023 year end. Senior Partner rates rose 11%, Counsel rates rose 12%, Senior Associates rates rose 9%, and Associates rates rose 3%. Though Associate rates increased last quarter, they did so at a much lower amount than in the past five years.

- Transactional rates are higher (again) than Litigation rates, but by less than in the past.

- M&A holds the top Transactional practice hourly rate, as these deals are in nature friendly over adversarial, focus on capitalized costs, and fees are expected to be paid on closing.

- The top hourly rates across Litigation fall under securities, antitrust, energy, complex commercial litigation, and tax.

- Discounting has decreased somewhat than in years past, only ranging from 5%-9% by position in Q1 2024.

- Across the pond, Magic Circle firms mirror the AMLAW 5 firms, with increases in Partner rates of 8%-9% and Associates from 7%-8%.

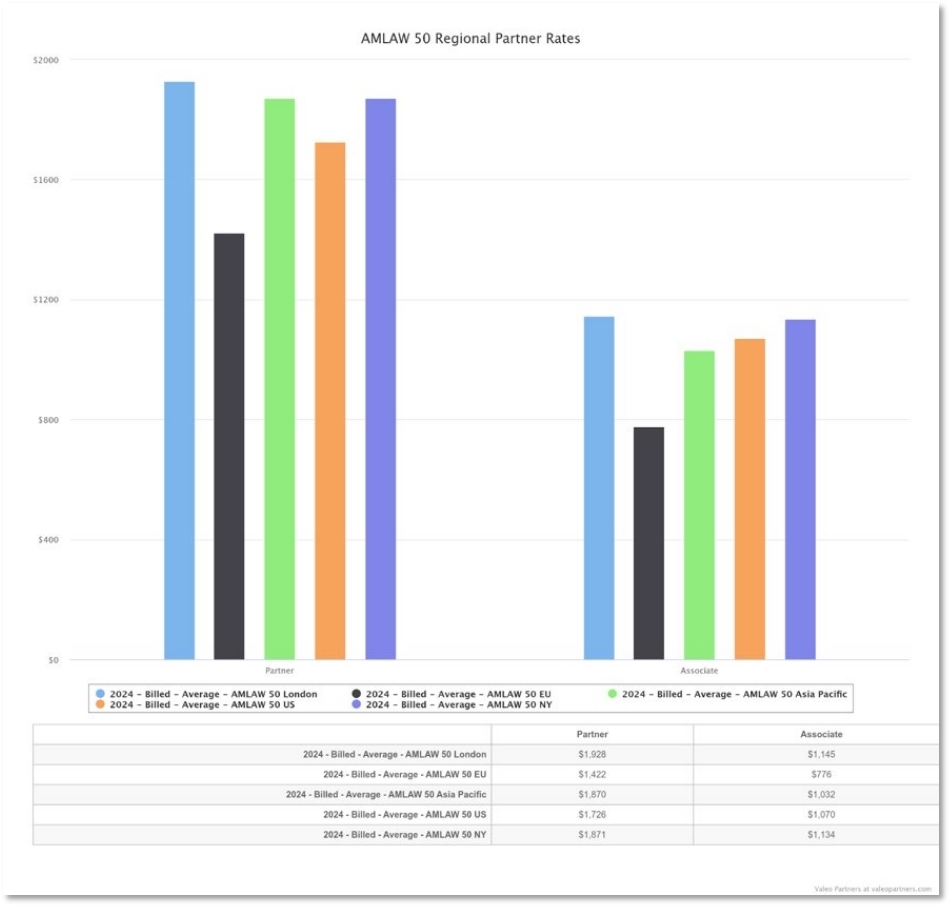

Magic Circle Partner rates are the highest across the globe. The chart below shows a comparison of AMLAW 50 regional Partner rates, with London at the top ($1,928/hour), followed by New York ($1,871), APAC ($1,870), United States ($1,726) and European Union ($1,422).

A Deeper Dive – Why Lawyer Hourly Rates Continue to Rise

Much is happening in our economy today and these trends have a direct impact on the increase of attorney hourly fees and rates. With many hoping and anticipating for lower interest rates to go into effect in June 2024, we can still attribute the rise in rates to the following economic factors:

- Witnessing a continued consolidation of law firms and the resulting concentration of expertise by less firms

- Increased deal activity across M&A carrying over from the end of 2023

- Corporations with large legal spends still enforcing hyper-strict billing policies

- Seeing the highest levels ever of corporate and PE cash, totaling around $10 Trillion

- Inflation

The Valeo Advantage – Predictions for the Year Remaining

After analyzing this data, I predict some movement in the following areas for the second half of 2024:

- Though rates will continue to rise this year, they will be less so than in years past. Discounting will also be less in 2024.

- Transactional rates will increase at a faster pace than Litigation rates from 2024-2025, rebounding as deals and rates rise.

- I recommend firms not price litigation and transactions solely on bankruptcy rates.

- AI, similar to other tech advancements in legal tech but more pronounced, will remove lower-expertise legal work but will be a BONANZA for high-expertise practices.

While most of the information I shared in the webinar is confidential to those who use the Valeo Pricing Platform, I can disclose how the platform aggregates and analyzes data to arm our customers with the most accurate information earlier in the rate-setting process. Valeo Partners hosts unmatched, up-to-date data and expertise to drive optimal rate structure across individual timekeepers, firms, practices, cities, and jurisdictions. We do so on the Valeo Attorney Hourly Rates Pricing Platform which details the hourly rates of individual Attorneys and Support Staff at over 2,900 law firms in 62 countries and 11 currencies. Law Firms, Corporate Counsel, and consulting firms worldwide have real-time legal rate data at their fingertips versus prior-year or prior-quarter data found in surveys and e-billing reports. Learn more here.